NF Daily Plan | 12th Mar 2024

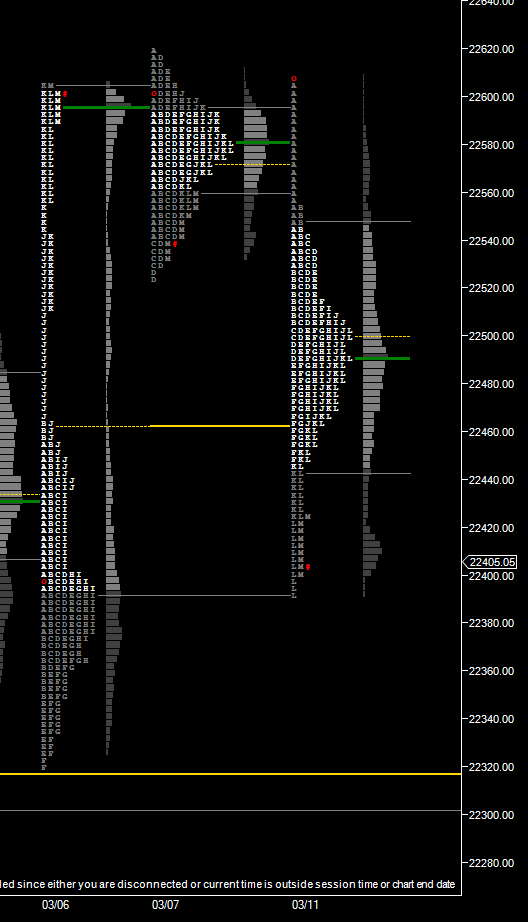

Daily Market Profile Chart :

NF previous session got higher value in the spike and is considered as bullish bias but higher value session closing below DVAL is not a good sign for the bullish momentum. Multiple contra info and so we remain neutral and look for follow through next session.

We have mentioned in the previous report that bulls to main the bullish momentum need to stay higher above 22590/22600 band else expecting some liquidations.

Today NF open drive down from this 22590/600 band to clear PDL and all day was spending time below PDL and then closed the spike zone to test VAL of the spike day (6th March) . NF closed as trend day down with good volumes and supply in control through out the session.

Now 22490-22500 band becomes an immediate resistance for next session. NF staying below this band can test 22320/22250 going forward. Bullish bias above this 22500 towards targeting 22527/22550/22560 levels.

Acceptance above 22560 is towards targeting 22580/22610 levels. Above 22610 targeting 22630/22650/22700/740 levels.

Nifty bulls should hold 22250 zone and look to bounce and if price accepts below 22250 towards targeting 22230/22160 levels.